How to Transfer MF Units Held in SoA

How to Transfer MF Units Held in SoA

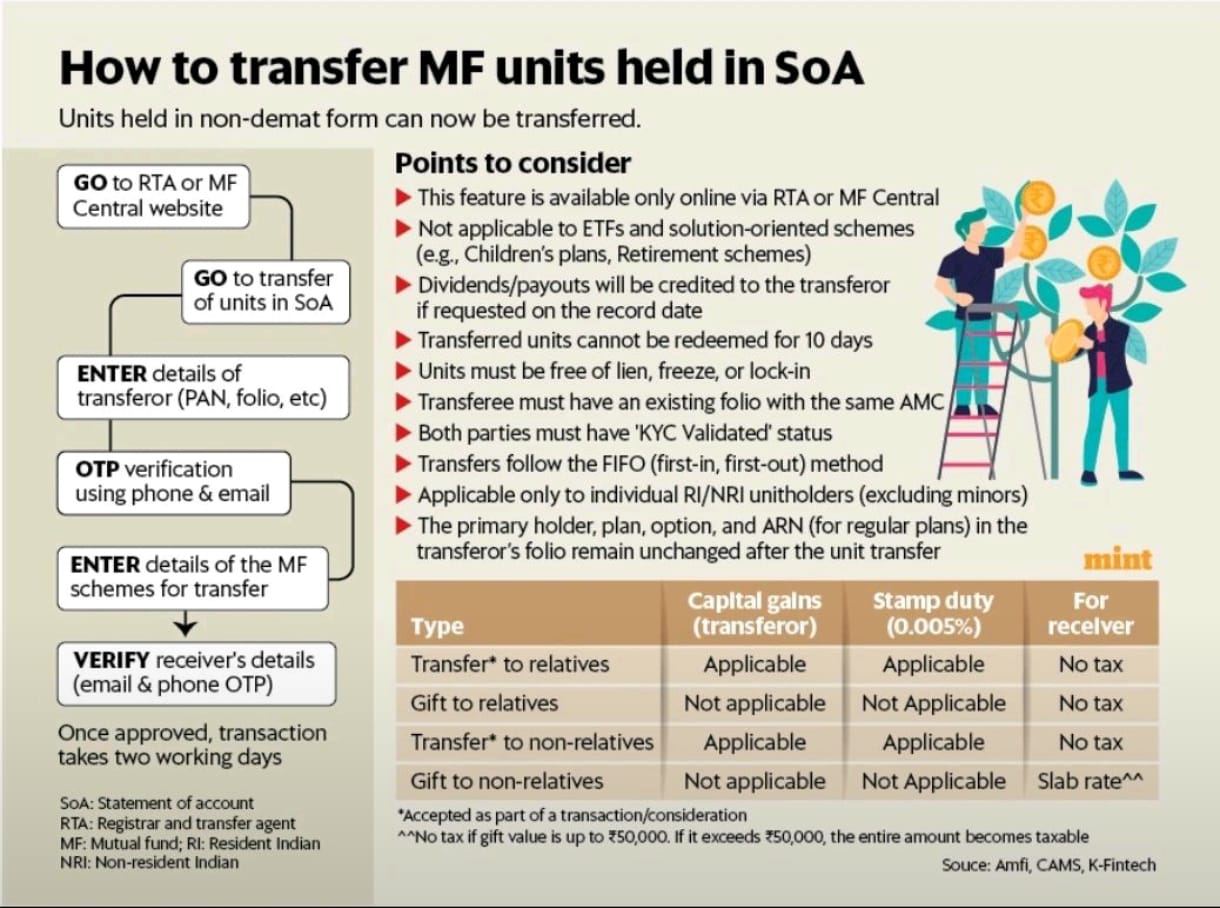

Transferring Mutual Fund (MF) units held in Statement of Account (SoA) is now simpler with online options. Follow these steps:

Steps to Transfer:

Go to the RTA (Registrar and Transfer Agent) or MF Central website.

Enter transferor details (PAN, folio, etc.) and verify with OTP via phone and email.

Provide details of the MF schemes to transfer.

Verify receiver’s details (email and phone OTP).

Once approved, the transaction takes two working days.

Points to Note:

This feature is available only online via RTA or MF Central.

Not applicable to ETFs, solution-oriented schemes (e.g., children’s plans, retirement schemes).

Dividends/payouts are credited to the transferor if requested on the record date.

Units cannot be redeemed for 10 days post-transfer.

Units must be free of lien, freeze, or lock-in.

Both transferor and transferee must have KYC Validated status and an existing folio with the same AMC.

Transfers follow the FIFO (first-in, first-out) method.

Applicable only to individual RI/NRI unitholders (excluding minors).

Primary holder, plan, option, and ARN remain unchanged after transfer.

Tax Implications:

| Type | Capital Gains (Transferor) | Stamp Duty (0.005%) | For Receiver |

|---|---|---|---|

| Transfer* to relatives | Applicable | Applicable | No tax |

| Gift to relatives | Not applicable | Not Applicable | No tax |

| Transfer* to non-relatives | Applicable | Applicable | No tax |

| Gift to non-relatives | Not applicable | Not Applicable | Slab rate^ |

*Accepted as part of a transaction/consideration

^No tax if gift value is up to ?50,000. If it exceeds ?50,000, the entire amount becomes taxable

Abbreviations:

SoA: Statement of account

RTA: Registrar and transfer agent

MF: Mutual fund; RI: Resident Indian

NRI: Non-resident Indian

Source: Amfi, CAMS, KFintech